The Basics of Financial Planning

Seeking Financial Security for the Years Ahead

By Susan Wells Courtney, under the direction of Thomas D. Foy, Jr.

Attaining financial security is a goal that everyone shares. This goal is particularly important for families whose financial obligations include caring for one or more members who are unable to work, and who may be sick or disabled. Having adequate funds available, as well as money held in a Trust with very specific instructions, are just two of several strategies that can help to ensure financial protection and security for your family in the years ahead.

Achieving such a goal, however, requires important decisions, sound investments, and informed planning for the future. Insurance, investments, Trusts, and Wills have become far more complicated than just a generation ago, when our parents were planning for their own futures.

Legal battles and the resultant changes in government laws over the years have led to the need for specific wording in all financial and health-related documents. New laws have added many restrictions. Without such important documents in place, you and your family may not necessarily have the opportunity to decide how one will be cared for, how the money will be distributed, and who will represent a family member if he or she cannot make decisions on his or her own.

According to Thomas D. Foy, Jr. of Foy Financial Services in Mount Laurel, New Jersey, specific language within a document is crucial for how things will be handled when the time comes to put these plans into action. While the expert MSAA consulted for the cover story, “Planning for the Future” (appearing in MSAA’s Fall 2005 issue of The Motivator), holds the opinion that most legal documents may be completed using standard forms without a lawyer, Mr. Foy strongly defends the need for a lawyer when creating documents such as Wills and Trusts. He also encourages seeking professional help when purchasing insurance and making investment decisions, all of which can have an enormous impact on a family’s financial future and healthcare choices.

What is the advantage of professional input? According to Mr. Foy, “Specific language is needed to follow HIPAA (Health Insurance Portability and Accountability Act) laws, which became effective in 1996. The legal forms found online probably do not cover all of the issues. Even with a Durable Power of Attorney, you need to have specific language to allow doctors to discuss personal information with the selected individual; otherwise, such forms are useless.” either opinion (whether to seek legal advice or not); but rather presents both arguments so readers may choose for themselves. Readers may also find a small amount of overlap between the two articles — as both talk about Durable Power of Attorney, Living Wills, and Wills — yet overall, this article focuses on the financial aspects, while the previous article focused more on the medical considerations. Readers who would like to see the previous article from the Fall 2005 issue of The Motivator may either visit MSAA’s website at mymsaa.org, select “publications” followed by “The Motivator,” or they may request a copy by calling MSAA at (800) 532-7667.

This article has been written under the professional guidance of Mr. Foy. As an experienced financial advisor, he has seen first-hand the advantages of planning for one’s future with the help of informed legal and financial experts. He has also seen the pitfalls of handling such plans improperly, as well as not having any plans in place. Some of the definitions given for the various documents and financial terms were found on Investorwords.com — an internet financial glossary.

The Basics, Part I: Income Replacement Strategies, Medical Insurance, and Estate Documents

The basics of any financial plan include income replacement strategies, adequate medical insurance coverage, carefully worded estate documents, and investment planning. The importance of having these plans, documents, and savings in place cannot be understated. These four areas of financial planning will protect and support you and your loved ones when employment and/or health situations change.

The basics of any financial plan include income replacement strategies, adequate medical insurance coverage, carefully worded estate documents, and investment planning. The importance of having these plans, documents, and savings in place cannot be understated. These four areas of financial planning will protect and support you and your loved ones when employment and/or health situations change.

Income replacement strategies, medical insurance, and estate documents are described in this first section on the basics of financial planning. In the following section (part II), an overview of investment planning is provided.

Income Replacement Strategies

The following four types of insurance plans provide income when someone becomes sick or hurt and is unable to work, or when this person dies. If you are eligible for these different types of insurance, having adequate coverage in these four areas will ensure that you and your family receive the necessary financial support when an income-earner in the household is no longer able to work. These include:

- Disability insurance

- Long-term care insurance

- Life insurance

- Critical illness insurance (new)

The latter type of insurance, “critical illness insurance,” is new and is quickly gaining popularity. This works by paying a lump sum to the policy holder if and when he or she is diagnosed with an illness that is listed as one of several predetermined “critical illnesses” (as specified in the policy). This provides the policy holder with a large amount of money in one payment, which can be used to take care of extra medical bills, as well as household and family expenses while unable to work.

Medical Insurance

Whenever possible, having adequate medical insurance coverage in place for each member of the family will not only allow for adequate medical care, but will also protect the family’s financial security. Whether being treated for a medical condition, long-term illness, or an unexpected injury, medical bills can add up fast and quickly deplete a family’s savings.

Opportunities for medical insurance coverage vary between the states. New Jersey has a “no pre-existing conditions” clause, so no one may be excluded due to a condition when starting with a new policy. While this means higher premiums because the insurance companies are forced to cover existing conditions, it also means that you won’t be left without coverage should you or a family member encounter a health problem while making a change with a policy.

Estate Documents

A Durable Power of Attorney, Advanced Medical Directive (Living Will), Wills, and Trusts are all different types of estate documents. According to Mr. Foy, “Today, every individual needs to have at least a Durable Power of Attorney, a Living Will, and a Will, all in place and up-to-date. These documents are crucial to your future as well as that of your family.”

Mr. Foy continues, “I also strongly recommend that individuals seek the advice of a legal professional when creating these documents. You can’t afford not to seek professional advice, especially in today’s highly scrutinized legal environment. If these documents are not worded correctly, you cannot be guaranteed that healthcare and financial instructions will be carried out according to your wishes. Additionally, government programs and medical assistance may be affected for a loved one if the money in a Will or Trust is not handled correctly.”

A Durable Power of Attorney and a Living Will are examples of “living documents,” which means that they are in effect while one is still living; after death, these are no longer active. Wills take over after one dies; and the different types of Trusts may be active during one’s lifetime as well as afterward. To follow is some general information about different types of estate documents.

Durable Power of Attorney (DPOA): This gives someone else the authority to act on your behalf and make decisions for you. It includes the ability to make medical decisions (“durable” adds the medical capacity). This document needs to be worded so that all rights are passed along should you become ill or injured and unable to make and communicate your own decisions. A good idea is to prepare this document in multiples, as you may need to surrender copies to the different professionals and/or institutions involved. Most people typically name a significant other and their children as choices for DPOA.

Living Will: This document is used to dictate how to be cared for in your final days. For example, it may include which life-prolonging procedures you may or may not choose to have, such as tube feeding or a respirator. Among other points, it also may state your preference as to where you would like to spend your final days (in a medical facility or at home).

Advanced Medical Directive: Also known as a “Healthcare Power,” this document combines a DPOA with a Living Will — either in one document or in two separate ones.

Will: Also known as a “Testament,” a Will takes over after death and explains how one’s property is distributed. The contents of a Will become public information, accessible to anyone after you die. A Will can also leave everything to a Living Trust, which has certain advantages, including confidentiality, even after you are gone.

Trust: This is a legal arrangement in which an individual (the trustor) gives legal control of property to a person or institute (the trustee), for the benefit of the trust’s beneficiaries — who will ultimately receive the property in the trust. A trustor is the individual who sets up a trust, also known as the grantor. The trustee is an individual or organization which holds or manages and invests assets for the benefit of another, often with the legal authority and duty to make decisions regarding financial matters.

As an addition to these documents, individuals may find that they have a need for other types of supporting documents. These may include a Living Trust, a Special Needs Trust, or a Testamentary Trust.

Living Trust: This Trust may be a substitute for a Will, but is frequently an entity within the Will, giving instructions that could replace all the other documents; it is perpetual and private. You can have the Will (which is public information) leave everything to the Living Trust (which remains confidential).

Special Needs Trust: This takes care of the special needs of someone who may be physically and/or mentally impaired. This trust allows someone to be creative within the Will or Trust, but may also be done separately. The trustor who creates the Special Needs Trust can distribute funds as needed before his or her death. Afterward, the appointed trustee or committee of trustees takes over how the funds are managed. Sometimes a life insurance policy will be used as a funding vehicle for a Special Needs Trust (so that after the trustor has died, his or her life insurance benefits are added into the Trust).

A carefully structured and adequately funded Trust can ensure that a spouse, child, or other family members with special needs are cared for throughout their years, even after the person supporting them is no longer living. Some individuals set-up a charity that may continue after the beneficiaries have also passed away.

Mr. Foy notes, “Any family who cares for a loved one with special needs should seriously consider seeking legal advice to create a Special Needs Trust. It should include language focused on the needs of the family member with physical or mental limitations. When drafted by a qualified attorney, the language should be specific enough to maximize state and federal benefits.”

Testamentary Trust: This is a Trust that is created within a Will and it does not take effect until the trustor’s death. Someone may want to set-up a Testamentary Trust when specific instructions are needed for how the funds and/or property are to be distributed. A series of instructions lists specific conditions for the beneficiary.

For instance, a Testamentary Trust may be advisable when the beneficiary is under 18 and you are concerned about the responsibility of the child; when the beneficiary is a “spendthrift;” or if the beneficiary may be facing financial problems — such as bankruptcy or divorce. This type of Trust can include “spendthrift language” to provide a level of liability, creditor, and bankruptcy protection.

Mr. Foy explains, “The funds are not easily accessible and this Trust protects the beneficiary from his or her own poor money management, as well as losing money to an ex-spouse during a divorce. A trustee has full power of discretion at the time of legal trouble, having the authority not to disperse any funding at that particular time. In order for this type of Trust to work in this capacity, it must be worded correctly by a lawyer.”

The Basics, Part II: Investment Planning

The first advice given by Mr. Foy is to assume that the government won’t provide assistance. To be safe, he recommends that a person assumes complete and total responsibility, not depending on any family entitlements. The best way to ensure one’s future financially is to save through the following two methods:

- Maximize saving through one’s employer, using a retirement plan such as a 401K.

- Create a portfolio of investments — whether for a retirement fund or other accumulated assets. Individuals may wish to seek investment advice to help determine their tolerance for risk and the appropriate investment selection designed to meet their identified investment goals.

For example, young families may be more growth oriented with their financial investments (high risk, high potential), and may choose to purchase company stocks. When people purchase mutual funds, they are investing in company stocks, but they reduce some of their risk because this includes stocks in several companies — so one’s success does not depend on the performance of a single company.

Older families, whose objective may be focused on conserving the principle of present investments, also known as “preservation of capital,” may stay with more conservative, less vulnerable investments (low-risk, consistent potential). Examples of such investments include cash equivalents (bank accounts, Certificates of Deposit) and Money Market Funds.

Opportunities are available for individuals who feel compelled to invest on their own, however, if someone has resources for investment and qualifies, then he or she may be well advised to seek professional advice. An excellent “how-to” guide on investing is a book by Peter Navarro titled, If It’s Raining in Brazil, Buy Starbucks (published by McGraw-Hill Companies; first edition, 2004).

Mr. Foy points out, “Various financial publications, such as Money Magazine, Fortune, Wall Street Journal, and Barron’s, may be recommended as resources for individuals to learn terminology and to find out about some general investing tips, but newcomers need to be skeptical of financial advice within these types of publications. Advice should be taken with a grain of salt, as financial editors are not the same as financial planners. Additionally, some may find that the financial advice in certain publications relates directly to the advertisers within the magazine.”

To follow are various types of investments, beginning with the most conservative, having the least risk and lowest potential for a high rate of return. As the list continues, it moves onto the least conservative investments, which have the greatest risk but also the best potential for a high rate of return.

MORE CONSERVATIVE INVESTMENTS WITH LESS RISK:

Cash Equivalents:

- Savings accounts

- Checking accounts

- Bank Certificates of Deposit (CDs)

Sometimes cash equivalents are insured by the FDIC. Most investments in general are not insured, because little money can be made if insured. These three types of investments are all handled through a bank.

According to Investorwords.com, a Certificate of Deposit is a short or medium-term, interest-bearing, FDIC-insured debt instrument offered by banks as well as savings and loans. CDs offer higher rates of return than most comparable investments, in exchange for tying up invested money for the duration of the certificate’s maturity. Money removed before maturity is subject to a penalty. CDs are low-risk, low-return investments, and are also known as “time deposits,” because the account holder has agreed to keep the money in the account for a specified amount of time, anywhere from three months to six years.

Money Market Funds

Money Market Funds are the safest form of mutual funds, although money markets are not insured. Money Market Funds are usually purchased at an investment firm. Investing money in cash equivalents through the bank (savings, checking, or CD) or through Money Market Funds, may not bring a high rate of return, but does provide a good deal of security, knowing that these types of investments carry the least amount of risk.

Investorwords.com defines a Money Market Fund as an open-ended mutual fund which invests only in money markets. These funds invest in short-term (one day to one year) debt obligations such as Treasury bills, Certificates of Deposit, and Commercial Paper (which is an unsecured obligation issued by a corporation or bank to finance its short-term credit needs). The main goal is the preservation of principal, accompanied by modest dividends. The fund’s net asset value remains a constant $1.00 per share to simplify accounting, but the interest rate does fluctuate.

Investorwords.com continues by noting that money market funds are very liquid investments, and therefore are often used by financial institutions to store money that is not currently invested. Although money market mutual funds are among the safest types of mutual funds, it still is possible for money market funds to fail, but it is unlikely. In fact, the biggest risk involved in investing in money market funds is the risk that inflation will outpace the funds’ returns, thereby eroding the purchasing power of the investor’s money.

Bonds

These are “fixed-income investments.” If held until maturity, the rate of return is guaranteed, as well as the return of the original investment. Purchasing bonds involves going through a professional such as a broker. Although not recommended, bonds may also be purchased through an internet trading company. Bonds in general have a relatively low risk for loss of investment. Examples of bonds include:

- Municipal bonds (issued by a legislative body)

- Corporate bonds (issued by a privately owned company)

- Government bonds (issued by the United States Treasury Department)

Investorwords.com defines a bond as a debt instrument issued for a period of more than one year with the purpose of raising capital by borrowing. The Federal government, states, cities, corporations, and many other types of institutions sell bonds. Generally, a bond is a promise to repay the principal along with interest (coupons) on a specified date (maturity). Some bonds do not pay interest, but all bonds require a repayment of principal. When an investor buys a bond, he or she becomes a creditor of the issuer, although the buyer does not gain any kind of ownership rights to the issuer.

Bonds are often divided into different categories based on tax status, credit quality, issuer type, maturity, and whether secured or unsecured (and there are several other ways to classify bonds as well). United States Treasury bonds are generally considered the safest unsecured bonds, since the possibility of the Treasury defaulting on payments is almost zero. The yield from a bond is made up of three components: coupon interest, capital gains, and interest on interest (if a bond pays no coupon interest, the only yield will be capital gains).

A riskier bond has to provide a higher payout to compensate for that additional risk. Some bonds are tax-exempt, and these are typically issued by municipal, county or state governments, whose interest payments are not subject to federal income tax, and sometimes also state or local income tax.

LESS CONSERVATIVE INVESTMENTS WITH GREATER RISK:

Mutual Funds

These are a safer way to invest in a corporation. The sole objective is for the portfolio manager to buy, sell, or hold securities (which include stocks and bonds) for all those who are investing. Mutual Funds may be just stocks, or they may include government bonds, real estate, or almost any other investment — even stock in oil futures. The purpose is to be diversified, providing a “basket of securities” for the investors. The portfolio manager oversees the entire “basket” of investments, enabling investors to each purchase a portion of the basket (holding several investments), so separate purchases of individual securities are not needed.

Investorwords.com defines a mutual fund as an open-ended fund operated by an investment company, which raises money from shareholders and invests in a group of assets, in accordance with a stated set of objectives. Mutual funds raise money by selling shares of the fund to the public, much like any other type of company can sell stock in itself to the public. Mutual funds then take the money they receive from the sale of their shares (along with any money made from previous investments) and use it to purchase various investment vehicles, such as stocks, bonds, and money market instruments.

In return for the money they give to the fund when purchasing shares, shareholders receive an equity position in the fund and, in effect, in each of its underlying securities. For most mutual funds, shareholders are free to sell their shares at any time, although the price of a share in a mutual fund will fluctuate daily, depending upon the performance of the securities held by the fund. Benefits of mutual funds include diversification and professional money management. Mutual funds offer choice, liquidity, and convenience, but charge fees and often require a minimum investment.

Mr. Foy notes that some individuals may consider using insurance company annuities as a means of not outliving their income. These serve a valuable function in certain financial plans, but they are highly complicated and can be very expensive. If structured correctly, annuities can hold investments similar to mutual funds. Individuals should not just buy any annuity; they need to use the right one from the right company, so again, Mr. Foy recommends seeking the advice of a professional.

Investorwords.com defines an annuity as a contract sold by an insurance company, designed to provide payments to the holder at specified intervals, usually after retirement. The holder is taxed only when he or she starts taking distributions or if funds from the account are withdrawn.

All annuities are tax-deferred, meaning that the earnings from investments in these accounts grow tax-deferred until withdrawal. Annuity earnings are also tax-deferred so they cannot be withdrawn without penalty until a certain specified age. Fixed annuities guarantee a certain payment amount, while variable annuities do not, but do have the potential for greater returns. Both are relatively safe, low-yielding investments.

Stocks

Stocks are usually purchased through an investment professional. Stocks may be from small companies, or they may be from large companies, which are known as “Blue Chip” stocks.

- Individuals investing in small companies are looking for a total return of investment, known as “capital appreciation.”

- Individuals investing in Blue Chip stocks are investing in big companies and are looking to receive periodic dividends.

As described by Investorwords.com, a stock is an instrument that signifies an ownership position (called equity) in a corporation, and represents a claim on its proportional share in the corporation’s assets and profits. Ownership in the company is determined by the number of shares a person owns divided by the total number of shares outstanding. For example, if a company has 1000 shares of stock outstanding and a person owns 50 of them, then he or she owns five percent of the company. Most stock also provides voting rights, which give shareholders a proportional vote in certain corporate decisions. Only a certain type of company called a corporation has stock; other types of companies such as sole proprietorships and limited partnerships do not issue stock.

Investing for the Future

Many individuals are on fixed incomes and have little extra cash for investments. Readers should note, however, that even a small amount of money saved or invested each month can add up over the years. “Financial calculators” are available on many financial websites. With these, individuals may look into various levels of investment and rate of return to determine how their financial investments may grow.

For example, if someone is able to find $100 per month (about $25 extra per week) to invest in a low-risk, fixed-interest type of account, and estimate the rate interest to be at two percent, the savings become significant after several years. Before tax and inflation (BTI) factors are figured in, saving $100 monthly at two percent interest will yield more than $13,000 after 10 years, and nearly $30,000 after 20 years. If the interest is at five percent, $100 monthly would grow to nearly $15,500 after 10 years and more than $40,000 after 20 years (BTI).

Of course, bigger investments into stocks can yield even greater profits—provided they perform well. Stocks are high-risk but have the potential for high interest and a strong return on investment.

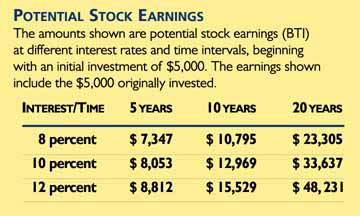

For someone investing a one-time amount of $5,000 into a stock, the chart below shows how that might potentially grow over the years. In this example, 100 shares of stock were purchased at $50 each (totaling $5,000), and the total earnings are listed BTI.

For More Information

For assistance with insurance options, readers may contact their local insurance agent, or they may also visit insurance company websites on the internet. Readers are cautioned to look into their options and compare costs, benefits, and the reputation of the insurance company before signing for an insurance policy designed to protect you and your family’s future. Examples include:

- Metropolitan Life Insurance Company at www.metlife.com

- Prudential Insurance Company of America at www.prudential.com

Regarding investments, Mr. Foy points out that many Mutual Fund companies have websites that provide a wealth of information. Often, these resources offer general investing information which is not necessarily designed to encourage selling their own products. Examples include:

- T. Rowe Price at www.troweprice.com

- Fidelity at www.fidelity.com

- Vanguard at www.vanguard.com

Other investment resources include Dow Jones at www.dowjones.com and MarketWatch from Dow Jones at www.marketwatch.com. Infoplease(tm) offers a listing of personal financial websites which may be found at www.infoplease.com/ipa/A0001507.html.

Readers may also consult the Foy Financial Services website at www.foyfinancial.com to learn more about personal finance and investments. Please note, however, that this agency, headed by Thomas D. Foy, Jr., is located in New Jersey. State securities laws require that your investment professional be registered in the state in which you are a resident. In order to meet this requirement, you must select the state where you reside from a drop-down menu before you may enter this site. If Mr. Foy is registered in that state, you may enter the site. Those who select a state in which Mr. Foy is not registered, will not be able to enter the site.

In Conclusion

Many readers of The Motivator may already be fully insured — to provide income replacement and medical coverage; they may also have all of their estate documents in place and up-to-date; and lastly, they may have their investment planning arranged to meet their long-term financial goals. For this portion of our readers, we hope that this article was a reminder to make sure that everything is current and able to meet all of your family’s needs.

For those individuals who may not have everything in place, this article was meant to stress the importance of long-term financial planning. It should also serve as a guide to inform you of what is needed for long-term security, and to direct you to the different resources for additional information and assistance. This article is for informational purposes only. MSAA and Foy Financial Services are not responsible for any legal and/or financial decisions made by our readers.

MSAA and its staff would like to thank Thomas D. Foy, Jr. for generously donating his time to the writing of this article. We hope that many of our readers may benefit from his valuable knowledge and expertise.